Question 1: PlanRadar has mentioned that digitalization in the construction sector has stagnated. Can you elaborate on the current state of digitialization and the key challenges the industry is facing in adopting digital technologies?

At PlanRadar, we acknowledge the significant impact that digital transformation has had over the past decade. In recent years, the construction industry has undergone a significant transformation through digitization, with a widespread adoption of digital tools and technologies. This shift has helped in many ways to streamline project management, enhance collaboration (through tools such as Building Information Modeling (BIM)), and improve overall efficiency by automating repetitive or time-intensive tasks such as design simulations and project scheduling. As a result, the construction sector has experienced increased productivity, reduced costs, and improved project outcomes – marking a fundamental evolution in what we consider to be more ‘traditional’ construction practices.

However, the absence of industry-wide standards for digital tools poses a potential barrier to adoption, interoperability and collaboration – so standardization is crucial for ensuring the seamless integration of existing software and new tools. Additionally, a shortage of skilled professionals capable of managing digital technologies highlights the necessity of bridging this skills gap through comprehensive training programs.

Concerns related to cybersecurity and data privacy can also impede the adoption of new tools and technology. Therefore, robust security measures are imperative to build trust within the industry. The fragmented nature of the construction software landscape often leads to inefficiencies that need to be addressed.

Tackling these challenges requires collaborative efforts from industry stakeholders. This includes the implementation of education and training programs, substantial investment in research and development, advocacy for standardization, and the establishment of supportive regulatory frameworks. We are also closely collaborating with the Building and Construction Authority (BCA) Singapore and the private sector, to support the efforts of these regulators in implementing new technologies within the Singapore construction industry.

Question 2: According to the survey results, what are the primary barriers preventing the wider adoption of digital technologies in the construction sector?

Many stakeholders in the construction industry may perceive digital construction software as costly without fully understanding the potential return on investment (ROI). If they do not see immediate benefits or are skeptical about the long-term gains, they may resist adopting these tools.

The upfront costs associated with implementing digital construction software, including purchasing licenses, hardware, and hiring specialists for integration, can be significant for many Singapore companies. Small and medium-sized construction firms, in particular, may find it challenging to allocate funds for such investments.

Key stakeholders in the construction sector within the Singapore and Malaysia region, such as project managers, contractors, and company owners, may also hold more traditional views when it comes to tech integration and resist deviating from established methods. This resistance can be a significant barrier to the adoption of digital tools.

The absence of regulations mandating the use of digital tools in construction and a lack of government incentives for adopting such technology – particularly in markets that have been historically resistant to embracing digitization – may also result in a slow pace of adoption. Without regulatory support or financial incentives, companies may be less motivated to invest in digital construction software. This can hinder the industry’s overall progress in embracing technology-driven solutions that could enhance safety, sustainability, and efficiency.

Some excellent examples of recent government incentives that drastically encourage the private sector to implement new digital technologies include The Productivity Solutions Grant (PSG) in Singapore and the Technology Voucher Programme (TVP) in Hong Kong SAR – these regulatory changes indicate a strong industry shift towards increasingly digital-driven construction projects.

Question 3: How does PlanRadar perceive these barriers, and are there specific strategies or solutions the company recommends to overcome them?

For the key industry challenges highlighted in the survey, there are several potential solutions to navigate or mitigate these barriers to digitization.

Decision-makers may be hesitant to invest in digital tools without a clear understanding of their potential benefits. To address this, conducting case studies and demonstrations that showcase successful implementations in similar construction projects is crucial. By providing quantifiable data on increased efficiency, error reduction, and improved project outcomes, collaborating with industry experts and organizations can highlight the tangible return on investment that can be achieved.

Perceived high implementation costs can discourage companies from adopting digital tools, limiting their access to long-term benefits like cost savings, streamlined processes, and improved project outcomes. To address this, offering flexible pricing models and conducting cost-benefit analyses can demonstrate the potential savings and efficiencies of digital tool adoption. Exploring partnerships with technology providers or government initiatives that offer financial incentives can further support the implementation of digital technologies in the construction sector.

Insufficient training can also hinder employees’ tool proficiency, leading to decreased productivity and project delays. A lack of tech-friendly company culture may exacerbate resistance to change, hindering successful implementation. In cases like these, investing in comprehensive training programs, fostering a culture of continuous learning and innovation, and establishing mentorship and support networks can encourage knowledge sharing and collaboration.

Additionally, without regulatory support or financial incentives, companies may hesitate to invest in digital construction software – impeding progress in adopting technology-driven solutions for safety, sustainability, and efficiency. Collaborating with regional industry associations and communicating with regulatory bodies can help advocate for supportive regulations and the benefits of digitalization. Also, participating in government initiatives or grants that offer financial or compliance incentives can showcase alignment with industry and societal goals.

Furthermore, a key aspect of implementing new digital technology is the dedicated support provided by our customer success teams. This support extends from field staff to management, ensuring a seamless adoption of the PlanRadar platform. We consider these efforts to be vital for successful implementation.

Question 4: Digitalization often involves collaboration between various stakeholders. How does PlanRadar foster collaboration among construction professionals, real estate agents, and facilities managers through its platform?

PlanRadar provides a centralized platform where all relevant stakeholders can collaborate, communicate and share information in real-time. This eliminates the need for fragmented communication channels and ensures that everyone involved in a project is on the same page.

Document management capabilities also allow users to upload and share project-related documents, plans, and reports. The platform can offer customizable workflows to accommodate the specific needs and processes of each customer.

Collaboration is further enhanced through features that enable the creation, assignment, and tracking of site tasks. This collaborative approach ensures that everyone involved is well-informed about ongoing tasks, project milestones, and potential challenges. PlanRadar’s access control features provide a secure environment, defining user permissions and roles to maintain confidentiality while facilitating effective real-time project collaboration for subcontractors and external teams.

PlanRadar understands the importance of integration in the construction and real estate industry, so our platform seamlessly integrates with other commonly used tools such as project management software and Building Information Modeling (BIM) tools, allowing for smooth data exchange and collaboration across different platforms. Additionally, our mobile accessibility empowers stakeholders to collaborate on the go, offering flexibility on-site, and managing tasks from any location.

We also allow a flexible approach to our user licensing models, where stakeholders can have view access to the platform free of charge. This allows subcontractors, consultants, and other third parties to access relevant project data, site tasks, and reports at any stage of the project lifecycle – with no additional costs involved.

Question 5: The survey spanned 15 countries. Were there notable differences in attitudes or challenges regarding digitalization in the construction sector across these regions?

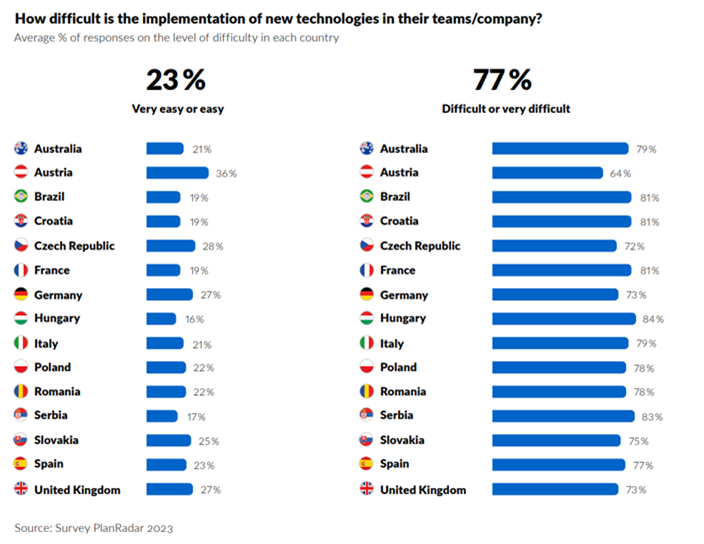

Throughout the surveyed regions, we have observed distinct variations in attitudes and challenges related to the digitalization of the construction sector. Stakeholder resistance to change has emerged as a significant barrier to the adoption of new technology, with 8 out of 15 countries identifying it as the primary challenge. This highlights a widespread resistance to change from established or more historical practices within the construction industry. Notably, the perception of a low return on investment closely followed, with 17% of Asia-Pacific companies, and approximately 25% in EU companies acknowledging this challenge. While this may be less prominent in regional tech hubs like Singapore, other countries such as Thailand and Malaysia may see this as a more significant challenge to tech adoption.

As we explore expectations regarding future investments in digitalization, over half of the respondents expressed an intention for their companies to increase their investment in digitalization by at least 11%, particularly in Europe. Conversely, we’re seeing that Asia-Pacific companies are more open to increasing digital investment, with 39% of respondents stating that they see upwards of a 31% investment in new technological tools over the next few years.

Question 6: How does PlanRadar tailored its approach to address the specific needs and challenges of different countries or regions?

PlanRadar is committed to creating tailored and accessible solutions for every market. We adapt our platform to comply with specific construction and real estate regulations in different countries and regions. This includes incorporating features that support adherence to local building codes, safety standards, and documentation requirements in compliance with Singapore’s regulatory and compliance environment. To ensure effective usage across diverse regions, we offer a multilingual interface that breaks down language barriers, and are actively working on more regionally available translations as our customer base grows.

We also have the ability customize content such as templates, forms, and documentation to align with the terminology and standards used in each country or region. Additionally, we allow API integration with other locally popular software used in the construction and real estate ecosystem, ensuring compatibility with project management tools, accounting software, and other industry-specific applications. To support users within their local industry practices, we provide region-specific training and support materials, including webinars, documentation, and customer support in local languages.

One of our major distinguishing factors in the market is the rich customization features and modular platform structure. Interestingly, wherever we expand into new countries or regions, while the local regulations, local building codes, and rules may differ, we often find that essentially the project management scope is quite similar – everyone is working with design plans and drawings, there are contractors and subcontractors to manage, and there are reports to submit.

Question 7: How does PlanRadar stay ahead in incorporating new technologies into its platform to support ongoing industry digitalization?

At PlanRadar, we prioritize continuous innovation through ongoing research and development efforts. We actively invest in monitoring trends, participating in industry conferences, and fostering collaborations with technology partners.

Collaboration is at the heart of our approach. We engage closely with construction industry professionals, real estate experts, and technology specialists to gain valuable insights into the challenges and opportunities shaping our industry. Furthermore, our platform is consciously designed with a flexible and modular architecture, ensuring seamless integration of new modules or technologies. This not only supports scalability but also positions us to adapt to future advancements while minimizing disruptions to the existing system.

To complement these efforts, we offer comprehensive training and onboarding for users, to leverage the full potential of our platform and encourage the adoption of the latest updates. Additionally, we remain vigilant in staying informed about industry standards and regulatory changes, implementing regular updates to address evolving requirements related to data security, privacy, and industry best practices.

Question 8: Can you provide insights into PlanRadar’s future roadmap? Are there any upcoming features or functionalities that the company is planning to introduce to enhance its platform?

Our PlanRadar company vision “For every building and asset in the world to be constructed and operated with a digital solution” represents quite an ambitious goal for us as a private company, and also for the whole industry in an era of ongoing digital transformation.

We are approaching this transformative journey in many ways, so I would split features and functionality into two groups. The first group is what could be used now (and what the construction industry is currently ready to adopt), and the second is what could be used in the next 5 years, but requires industry and regulations to reach certain maturity. For example, the growing incorporation and potential of AI lies definitely within the second group.

Currently, our main focus is to continue enhancing user experience, improving our existing product offering and functionality for features such as BIM and scheduling management, adding more local languages as we expand into more countries globally, and increasing our focus on regulatory compliance for new regions.